The past week has presented a continuation of the recent price stabilization period, whereby a majority of the assets across the cryptocurrency market have primarily stagnated in value. However, as always, there have been a few deviations across the market, with some assets taking a sharp incline, while others plummeted in a bearish spiral. The likes of ETH and DOGE have been some of the positive gaining outliers and have increased by up to 5% this past week, whereas the likes of HBAR and APT have shed over 10%. As of the 9th of April, the cryptocurrency market cap stands at $1.18T, a $200 million increase from the week prior and a 0.70% increase across the past 24 hours.

Bitcoin (BTC)

Opening the week at $27.94k, Bitcoin was subject to substantial volatility across the past week, which has volleyed it from the lower boundaries of $27k to the middle region of $28k. On the 3rd, BTC remained above its 7-day SMA before plunging below the threshold and repeating this trend throughout the coming days, which led it to a weekly low of $27,430. However, following this low on the 4th, BTC rose to a weekly high of $28,633 on the 5th. Following this promising high, Bitcoin began to trundle once again and float between $27,779 and $28,129 for the remainder of the week, emphasizing a continued price stagnation.

Having continued the recent trend for volatility prior to price stagnation from the mid $27k to the low $28k regions, which appears to be acting as its new average trading zone. As a result, it appears as if the mid $27k zone is now acting as the new price floor, with the mid $28k threshold appearing to be the new primary resistance zone. In total, BTC rose by 0.51% this week.

Ethereum (ETH)

With ETH’s Shanghai upgrade imminent, the Ethereum community, as well as the wider crypto market, has endured a noteworthy interest surge in the asset. As more investors grow eager to unlock their ETH, more and more investors have flocked to take advantage of the current roster of ETH staking opportunities in the hopes of reaping the rewards. As a result, ETH has been subject to a sharp uptick in valuation and volume this week. Entering the week at $1779, ETH endured an upward trading trajectory that ensued throughout the first half of the week and pushed it to a weekly high of $1,922. Following this high, ETH began to fall moderately and appeared to even out on the 7th, ETH trading hands at an average of $1,865 for the remainder of the week.

Having continued the recent trend of upward momentum, Ethereum is likely to continue this trading trajectory, particularly as the ETH Shanghai upgrade looms closer. This could potentially push ETH toward the $2,000 threshold and allow it to push to a six-month high. In total, Ethereum increased by 4.04% this past week.

Dogecoin (DOGE)

With the recent promotion from Elon Musk leading to a swift surge in interest from wider Twitter communities, DOGE has continued to trade at an incline. Entering the week at $0.079, following a notable decline following last week’s bullish surge, DOGE remained below its 7-day SMA until the late hours of the 3rd, where it was then subject to a significant spike in valuation. Thus, Dogecoin had flung to a weekly high of $0.1016. Following this, it began to trundle downward, with this momentum extending throughout the latter portion of the week. On the 7th, DOGE’s downward spiral appeared to level out, leading it to trade horizontally at an average of $0.082.

With this immense volatility, DOGE is likely to continue this trading pattern provided the community sentiment fluctuates as a result of promotion from influential figures. This could lead it to further test the $0.1 zone. Across the past week, DOGE increased by 5.42%.

Hedera (HBAR)

Across the past week, Hedera has begun to deviate from its recent upward trading pattern, which has led it to plummet in a downward spiral. Entering the week at a promising $0.072, HBAR then sunk beneath its 7-day SMA and attempted to regain its footing to no avail, with HBAR sharply falling into the $0.06 zone. This downward momentum refused to cease, however, leading it to close the week at a weekly low of $0.063.

Having now carved out a bearish trading pattern, it appears as if HBAR is poised for a series of volatile weeks in the near future, which could lead it to descend further through the $0.06, and even the $0.05, zones respectively, providing that HBAR is unable to regain some positive momentum. Across the past week, HBAR fell by 10.01%.

Aptos (APT)

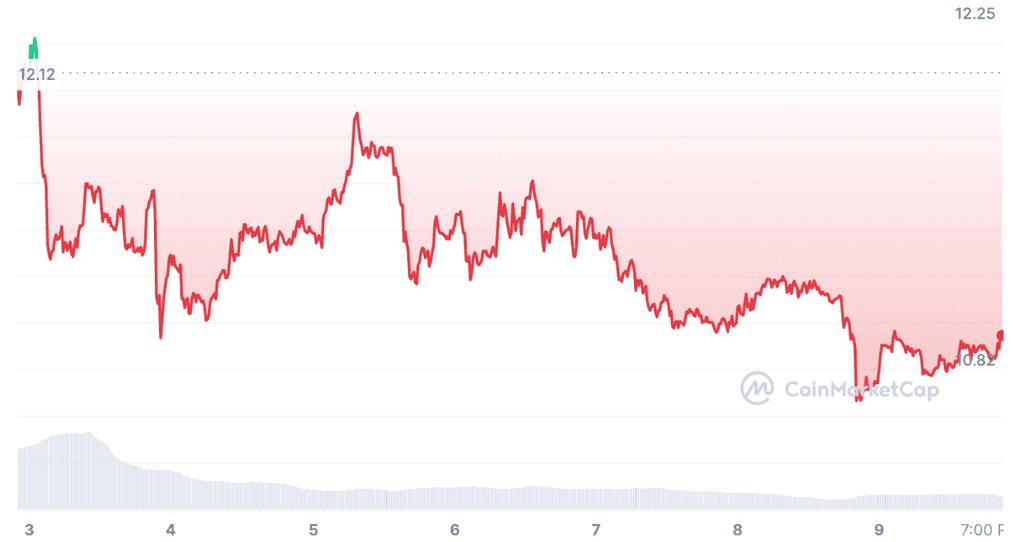

With Aptos pushing into a bullish trading pattern only three weeks ago, it has seemingly resumed a bearish trading trajectory. Having opened the week at $12.12, APT immediately fell beneath its 7-day SMA and traveled down a sharp red candlestick that plummeted it toward $11. Following this, APT fought against this price adversity, pushing toward the upper boundaries of the $11 zone repeatedly, yet, ultimately this resistance appeared to be futile, as APT ended up sinking into the upper $10 region on the 9th after reaching a weekly low of $10.82.

With the recent volatile trend, it appears as if APT is set for a progressive downward spiral which could potentially force it deeper into the $10 zone, with little avail. Across the past week, APT fell by 8.44% in trade.